Das Healthcare: A Promising Investment Opportunity

Das healthcare has emerged as a critically important sector in the global economy, combining complex systems of medical care with the investment strategies necessary for its growth and innovation. With an aging population, rising health awareness, and technological advancements, investing in this field is not only timely but essential for forward-thinking investors. In this article, we delve into the multifaceted world of das healthcare and why it represents a lucrative investment landscape.

The Current Landscape of Das Healthcare

The healthcare sector encompasses a wide range of industries, including pharmaceuticals, biotechnology, medical devices, and health insurance. The integration of technology into healthcare, often referred to as HealthTech, further revolutionizes patient care and investments.

Global Trends Influencing Das Healthcare

Several macroeconomic factors are reshaping the healthcare landscape:

- Demographic Shifts: An increase in the elderly population globally is driving demand for healthcare services.

- Technological Advancements: Innovations such as telemedicine and wearable health tech are becoming mainstream.

- Regulatory Changes: Governments are reforming healthcare policies to improve accessibility and reduce costs.

Investment Opportunities in Das Healthcare

Investors looking at das healthcare can glean insights into which sectors are potentially profitable:

Pharmaceuticals and Biotechnology

Investing in pharmaceutical companies provides exposure to a sector driven by research and development. Companies that succeed in creating effective drugs can see substantial returns. Key areas to watch include:

- Acquisition of Biotech Firms: With larger companies acquiring promising startups, this area offers significant growth potential.

- Specialty Drugs: The rise of specialty medicines tailored to chronic conditions increases revenue streams.

Medical Devices and Equipment

As technologies advance, medical devices are rapidly evolving. The demand for minimally invasive procedures is driving investments in:

- Robotic Surgery Equipment: A growing number of hospitals are adopting robotic-assisted surgical systems.

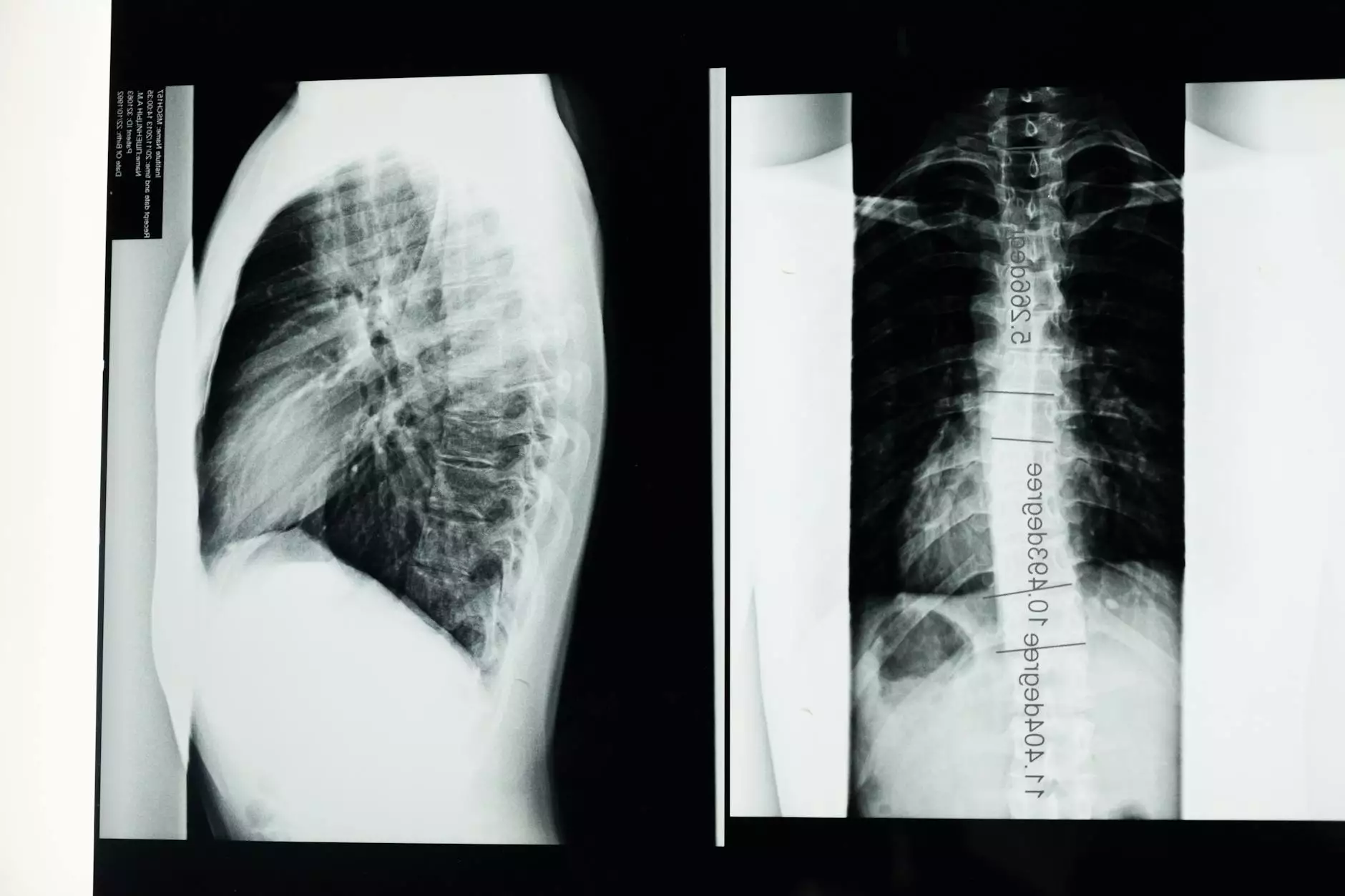

- Diagnostic Equipment: Diagnostic tools, such as imaging technologies, are crucial for early disease detection.

Health Insurance

Investment in healthcare insurance companies is a defensive play. These companies benefit from increased healthcare costs. Factors contributing to their performance include:

- Policy Reforms: Recent reforms are broadening coverage, increasing the customer base for insurers.

- Technological Integration: Companies leveraging technology for better customer service see improved satisfaction and retention.

Evaluating Risks in Das Healthcare Investments

While das healthcare presents numerous opportunities, investors must also be cognizant of the inherent risks:

Regulatory Risks

Healthcare is one of the most regulated industries. Changes in legislation can vastly affect investors’ returns. Keeping abreast of regulatory trends is essential for risk management.

Market Competition

The sector is highly competitive. New entrants can disrupt established players, necessitating constant innovation and adaptation.

Technological Uncertainty

As technologies develop quickly, investments may become obsolete if companies fail to adapt to new innovations.

Strategies for Investing in Das Healthcare

To effectively invest in das healthcare, consider the following strategies:

1. Diversification

Investing across various sub-sectors within healthcare can mitigate risk. A diversified portfolio can protect against downturns in any individual sector.

2. Research and Due Diligence

Conducting thorough research is essential. Assess companies based on their financial health, market position, and growth prospects.

3. Long-term Focus

The healthcare market can be volatile. Having a long-term horizon allows investors to ride out fluctuations while benefiting from overall growth.

The Future of Das Healthcare Investments

The future of das healthcare is promising, driven by ongoing innovation and the relentless pursuit of improved patient outcomes. Key trends to watch include:

Increased Personalization in Treatment

Medicine is shifting towards a more personalized approach, with treatments tailored to individual genetic profiles, which will open new investment channels.

Telemedicine Growth

The use of telemedicine has surged, particularly post-pandemic. This trend will likely continue, providing ample opportunities for technology-based investments.

Focus on Preventative Care

Investments in preventative care solutions, including wellness programs and nutritional health, are gaining traction as consumers become more health-conscious.

Conclusion: Embracing the Possibilities of Das Healthcare

As we navigate through the complexities of modern health and medicine, the allure of das healthcare as an investment arena will continue to grow. With the right strategies, a keen eye for emerging trends, and a commitment to ongoing education, investors can tap into this dynamic sector, reaping the rewards that come with it. Now is the time to explore the vast potential that das healthcare offers—it might just be the key to a prosperous investment portfolio.